Next, you’ll need to pay the IRS tax rules in order to enjoy the associated tax benefits of an IRA. If you have an IRA, your current brokerage might offer self-directed options but there are certain firms that specialize in this type of IRA. There are, however, a few additional rules to know about these accounts.įirst, investing in a self-directed IRA requires a custodian or trustee that can help with facilitating alternative investments. In short, a self-directed IRA can allow for greater diversification in your portfolio compared to the standard IRA options. Some of the investment options for a self-directed IRA include: What sets them apart is what you can use them to invest in. Self-directed IRAs are subject to the same tax rules and annual contribution limits as other IRAs. At first glance, that doesn’t sound much different from a traditional or Roth IRA and in reality, it’s not. they are not responsible for and are not bound by any statements, representations, warranties, or agreements made by any such person or entity and do not provide any recommendation on the quality profitability, or reputability of any investment, individual, or company.A self-directed IRA is an individual retirement account that can be used to hold a variety of investments. they do not make any recommendations to any person or entity associated with investments of any type (including financial representatives, investment promoters or companies, or employees, agents, or representatives associated with these firms). jim hitt and his team have grown the company to over $700 million in assets under administration by educating the public that their self-directed ira account can invest in a variety of assets such as real estate, private lending, limited liability companies, precious metals, and much more.Īs a self-directed ira administrator, they are a neutral third party. The mission of american ira is to provide the highest level of customer service in the self-directed retirement industry. "american ira, llc was established in 2004 by jim hitt, founder in asheville, nc. Interested parties may also reach out to the self-directed ira administration firm american ira by dialing 866-7500-ira. alternatively, anyone interested in learning more about checkbook iras and how they work can reach out to turnkey ira directly by dialing 844-8876-ira (472). To find out more about the blog post, interested parties may find the website at. there are a lot of possibilities when investors use checkbook iras-and many of these possibilities are at the discretion of the investor. with checkbook control, investors can leverage their retirement funds to access these investment opportunities and potentially reap the benefits of their growth.

these types of investments have historically offered significant returns, but they are typically limited to accredited investors. Private equity and venture capital investments are also accessible through a checkbook ira. the potential income and tax benefits associated with real estate investments can be substantial, making it an attractive option for retirement savings. investors can use their retirement funds to invest in rental properties, commercial real estate, or even raw land.

real estate is a prime example of an alternative asset that can be accessed through a checkbook ira. traditional retirement accounts often limit investors to traditional assets, but a checkbook ira opens the door to non-traditional investments. The ability to invest in alternative assets is another major advantage of a checkbook ira.

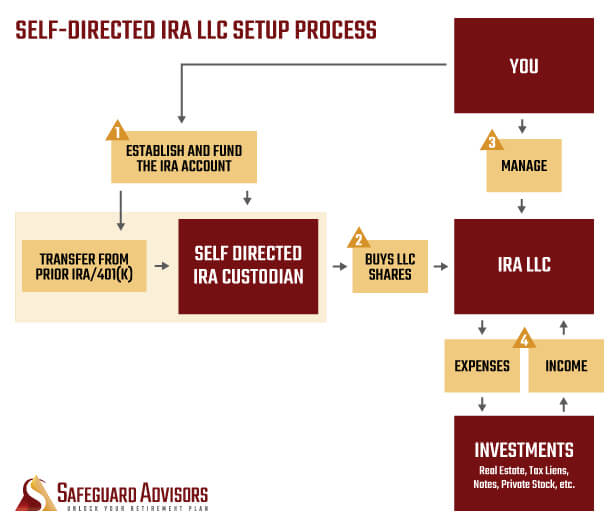

but with checkbook control possible through a self-directed checkbook ira, an investor has much more flexibility. the traditional approach to retirement accounts is to invest only in bonds, stocks, and stock or bond funds. In the post, turnkey ira highlighted how checkbook iras can“streamline” investment control. but how do investors know when this is the right situation? a recent blog post at turnkey ira highlighted the answers. this means investors can exercise a great degree of flexibility and control in a retirement account. this arrangement, in which a self-directed ira investor holds a single member llc with a bank account within the ira, means that checkbook control reverts back to the holder of the ira. one key decision that can offer more flexibility and control than many investors are used to is known as the checkbook ira. but when can investors know it's the right option for them?Īsheville, north carolina, usa, june 24, 2023/einpresswire / - there is much more to retirement accounts than many investors know. A self-directed ira which holds checkbook control can be a powerful way to invest.

0 kommentar(er)

0 kommentar(er)